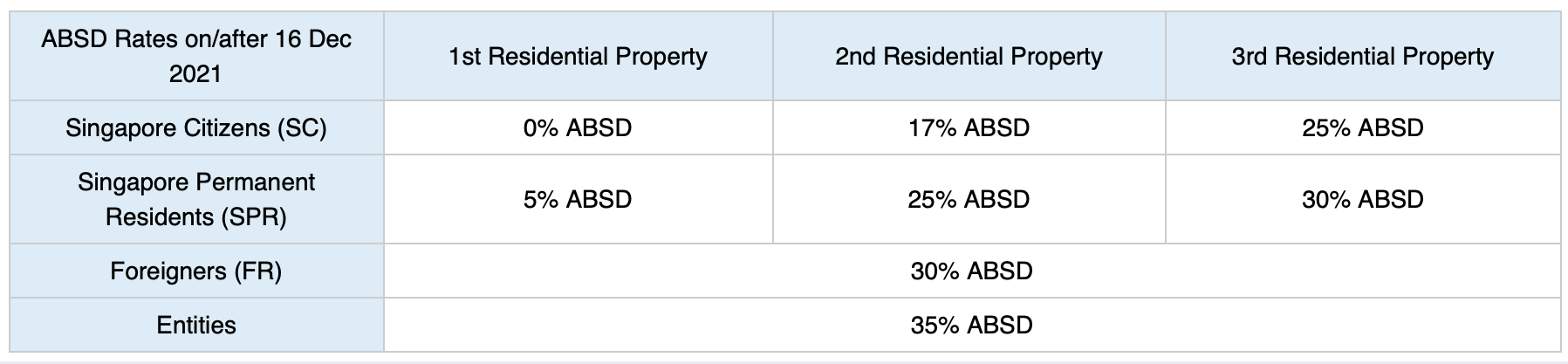

Firstly, let us take a look at the ABSD (Additional Buyer’s Stamp Duty) rates.

The ABSD rates are imposed on top on the standard BSD rates. It is calculated based on the purchase price/valuation of the property, whichever amount is higher.

Let us look at this example: Peter, a Singaporean, currently owns 1 property. He intends to purchase a 2nd property that cost S$1 million.

Breakdown:

Price: S$1,000,000 | BSD: S$24,600 | ABSD: S$170,000 Total: S$1,194,600

An initial purchase of S$1 million would be close to S$1.2million after factoring in the BSD and ABSD.

So how exactly can people still own multiple properties with the current

sky-high ABSD rate?

There are a few ways to avoid incurring the cost of ABSD (Legally), depending on which stage of the purchase process you’re currently at. (1) Purchasing your first property currently and planning to save on ABSD in future when you eventually purchase your second one. If you fall under this category, PAY CLOSE ATTENTION to this guide as it will help you save lots of money and trouble in the near future when you’re purchasing your second property. OR (2) Currently own a property and planning to purchase a second property. If this is you, fret not! This guide will provide you with a sound solution that will get you out of the sticky situation!

Listing your spouse as an Essential Occupier

instead of Co-Owner

This is especially important as it might not work for everyone, even if it work for you, you might have to consider a slightly smaller or more affordable housing option.

When purchasing a property, instead of listing your spouse as a co-owner (Joint purchase), list your spouse as an essential occupier instead. This means that you will be the sole owner of the unit.

Important: Being the sole owner of the unit, your spouse will not be able to utilize his/her CPF for the purchase/the repayment of the monthly mortgage. His/her income will also not be taken into consideration when applying for loan.

With that said, the total loan eligible will be much lesser. As such, you might have to consider purchasing a smaller unit or a more affordable one. On the other hand, repayment for the monthly mortgages will have to be worked out between the both of you on how the bill should be split.

Thereafter, when you finally decide on purchasing a second property, simply purchase it under your spouse name as a first-time buyer and you will be able to save on the ABSD!

[Pros]

– Ideal for 1st time home buyer

– Save on ABSD and legal fees on the 2nd home purchase

– The essential occupier will be able to save more money in the CPF for subsequent purchase

– Fuss-free when purchasing 2nd property

[Cons]

– Lesser loan amount

– Only the CPF funds of the sole owner can be used

– Have to work out a way to split the monthly mortgages

Decoupling (Does not work on HDBs)

No, it does not mean getting a divorce. To put it in simple words, it refers to the transfer of shares from one co-owner to the other co-owner. After the transfer, the exiting party will no longer own any property and his/her subsequent purchase will be counted as a first purchase, therefore, no ABSD will be applicable.

However, take note that BSD still applies and there will be legal fees involved as well.

Another point to note would be that the co-owner taking over the shares will have to refund the exiting party’s CPF used plus accrued interest.

Let us look at this example: Peter and Mary jointly own a private property worth S$1 Million. Mary transfers her share (50%) to Peter. Peter is now the sole owner of the property and Mary no longer own any property. Mary will then be able purchase another property without incurring ABSD.

Mary’s Shares in the property

50% x S$1 Million = S$500,000

Costs Involved in Decoupling:

Legal Fees: S$5,000 (Aprox.) | BSD: S$9,600 Total Cost of Decoupling = S$14,600

In Peter & Mary’s case, their total cost of decoupling works out to be S$14,600. For decoupling to work, you should make sure that the cost involve is less than the ABSD itself. If not, it would be pointless to utilise this method. [Pros] – Save on ABSD for the next purchase

[Cons] – Does not work for HDB – BSD and legal fees still applies – Co-owner taking over must have sufficient Cash/CPF to refund the exiting party

– Co-owner taking over must also be able to handle the remaining loan single-handedly

99/1 (Also known as Part Share)

This method goes together with decoupling. This form of purchase will involve a part share of ownership between the purchasers, where one party holds 99% of the shares and another holds just 1%. The benefit of doing so will allow both of your income to be used for loan application. On top of that, both of your CPF can be used for the purchase as well as the repayment of monthly mortgage installment.

When you want to purchase a 2nd property, simply decouple the 1% share to the other co-owner and you will be able to save on the ABSD for the subsequent purchase. Of course, the BSD will still apply, but it will be based on the 1% share price.

Let us look at another example: Peter and Mary own a private property worth S$1 Million. Peter owns 99% shares while Mary owns 1% share. Mary transfers her share (1%) to Peter. Peter is now the sole owner of the property and Mary no longer own any property. Mary will then be able purchase another property without incurring ABSD.

Mary Shares in the property

1% x S$1 Million = S$10,000

Cost Involved in Decoupling

BSD: S$100 | Legal Fees: S$5,000 (Aprox.) Total Cost of Decoupling = S$5,100

Their total cost of decoupling for this method works out to be S$5,100.

[Pros] – Save on ABSD for subsequent purchase – Allow all owners to utilize CPF for the purchase and monthly mortgage instalment

[Cons] – Standard decoupling legal cost still applies – Government might still impose tax if they deem your motive as avoidance of tax (Talk to your lawyer first before carrying out this method)

Purchase Under Trust

For this method to work, you must be rich (Cash-Rich).

You cannot get a bank loan for trust property nor can you use CPF for the purchase.

However, if you currently own a private property or any other forms of equity, you might be able to do a gear-up out of your asset to at least take some loans. You might want to talk to your banker to find out more about this.

Purchasing under trust simply means the purchase of a property and naming it under trust for your children. Through the method, you will not be considered as an owner of the property and therefore, no ABSD is applicable. However, there are some considerations that comes with this method of purchase. One of which would be that your children will not be able to purchase a flat in future, which might in turn affect their plans.

Another consideration that come with it would be that your children will be the legal owner of the property. Which also means that they have full rights to that property, and they can sell or rent to whoever they want, as and whenever they want or even use it as a collateral for loans. I believe we have all seen some similar cases like this which ended up in courts. [Pros] – Save on ABSD

[Cons]

– Purchase must in Full Cash (No bank loans/CPF) – Government might still impose tax if they deem your motive as avoidance of tax

(Talk to your lawyer first before carrying out this method)

– Might affect your children future property purchase

Commercial/ Industrial Property

Commercial and industrial properties are not subjected to ABSD. However, the GST of 7% still applies. These properties usually fetch a higher rental yield (Approx. 5%) as compared to residential properties (2%-3%). However, investing in commercial/industrial properties is an entirely different ball game. For first-time commercial investors, there are a few things to consider before you embark upon your investment. Factors such as re-zoning, new developments in the area, infrastructure etc.

For instance, the property you are looking at may have a strong sale due to its proximity to an MRT station, or a densely populated Condos/HDB flats. However, if some of these projects are put through an Enbloc sale, or for whatever reason, the human traffic was slashed. This would affect the ability of the property owner to churn a profit and to sustain the business. Other factors to consider may include, the type of commercial/industrial property you want, location of the property, rental yield, property tax and all other additional costs. Commercial property requires a lot more research and understanding, so make sure to do your homework before you invest in one! [Pros] – No ABSD applicable – Higher rental yield

[Cons]

– GST still applies – Requires a lot more research and understanding

Sell Your Current Property and Buying 2 More

As cliché as it sounds, sometime selling your current property may prove to be a better move. For instance, your current property is a leasehold property with 60 years lease left. The value of your property will no longer appreciate and the longer you hold, the more value you lose. In such case, you should consider selling it and purchasing 2 more units using the profit you make from the sales of your current unit. But this time, buying it under 2 separate names, one under your name and the other under your spouse name. This way, you will be able to save on the ABSD. Let us look at this example Peter and Mary sold their private property worth S$1 Million. They now decide to purchase a terrace for own-stay and another condo for investment. Terrace Price – S$2.5 Million Down Payment (25%) – S$625,000 (Paid with the sales proceed from their previous property) Condo Price – S$1.5 Million Down Payment (25%) – S$375,000 (Paid with the sales proceeds from their previous property)

Peter and Mary now both own 2 properties together. This is just a general example of how you could go about selling 1 unit and purchasing 2 more thereafter, you will still have to consider other costs like BSD and legal fees. On top of that, you will have to qualify for your mortgages, respectively. [Pros] – Save on ABSD

– Able to own 2 properties immediately

[Cons] – Sales from current unit may not be enough for the down payment of 2 more units – Both parties must qualify for mortgages, respectively

So, there you have it!

These are the different methods you may adopt to save on the hefty cost of ABSD! Then again, there are no best method to save on ABSD, a lot of it depends on your current situation, financing ability, family profile and plans. However, if you need any advice in making a better decision, feel free to reach out to me!